To all my readers for the last 8 months, thanks for reading! I'm going to take a break from blogging, and will be shuttering Michael Grabowski. If/when I start a new site, it won't be a continuation of this one, so you can safely remove it from your subscriptions and RSS feeds as it won't have another update.

Thanks again!

Sunday, December 4, 2011

Monday, November 28, 2011

Buying a Car: Part 3

Finally bit the bullet and got a car, a new 2012 Nissan Versa SV sedan. It's surprisingly big, has good gas mileage, and best of all it really squeals the tires going 0 to 60 mph in a breathtaking 10.2 seconds.

How did I end up getting the car? I got a decent price of $14,975 from a Chicago dealer, shopped that around in New Jersey

From what I understand, this seems to a be a standard fee.

Dealer Title Documentation Fee: $75

Another standard fee, although apparently this fee can be used by dealerships to recoup money in a sale. Keep an eye on it because it can widely vary from dealership to dealership. I think $75 was more-or-less reasonable.

VIN Etch Title Policy: $395

This is supposed to be a way to help prevent automobile theft, but I think it's a basically a modern-day rust proofing. Just a way to get more money out of me. I could have probably haggled and lowered this fee.

Uncle Sam needs to get paid, there's no avoiding that.

So, at after all the taxes and fees, the car comes to $16,903. Decently expensive, but I plan on keeping the car for a bare minimum of seven years. So, if you factor that in, the cost per year comes out to a reasonable level, assuming low maintenance costs. I paid in cash money, because Debt is Slavery. More on that in a later post.

I read a recent article that posed the question: Why are US teenagers driving less? I think I know the answer. It's because everything about owning a car is a pain in the ass. Buying a car, driving it, fueling it, maintaining it, insuring it, selling it... Everything is a big, complicated, time-consuming pain in the ass. If I didn't absolutely need to own a car, I wouldn't.

I love reading stories about people avoiding car ownership, which seem to be popping up more and more often. Cars seem to be the big status symbol of the baby boomers, an item people bought without really thinking if they needed it or not just to show off. Luxury items are fine, but cars are really, really expensive, even the cheap ones. As more and more households go from two-car to one-car to simply carless, their lives lives will simplify and they'll be better off for it.

Sunday, November 27, 2011

Sunday, November 20, 2011

Buying a Car: Part 2

Update for this week: I've received a bunch of different offers from a ton of different dealerships for a new 2012 Nissan Versa SV sedan. Thanks edmunds.com! The best walk out the door price I have is for $14,975 from a dealership in Chicago

Of course, I don't think the dealer was born yesterday and is going through the hassle of selling a car to only net a couple hundred bucks. The dealer that gave me that price is a very large dealership in Chicago

Furthermore, I'm shopping for a car close to Thanksgiving. There aren't a ton of car buyers at this time of year. That fact coupled with us being close to the end of the month means that the dealership is probably trying to squeeze sales in to meet their quota. That means I'll get a better deal.

That's what appears to be a great price from a Chicago dealer but I would like to purchase the car in New Jersey New Jersey and primarily driven there, so if I buy in Chicago New Jersey

So, at the end of the day I should have a new car with a price that I can live with. Still, there's a lot of bullshit haggling involved. I've sent and received around 25 emails. I've gotten a bunch of phone calls. I wish I could go on the Nissan website and just build the car, get a price without any haggling, and order the car there. You can go on the Nissan website and build the car, but at the end of the process you still have to talk to dealerships. This reminded me of an experience I had abroad.

When I went to South Korea

The thing is, I had great service wherever I went in South Korea America

At the end of the day, it's just a waste of time. Get rid of the tip, pay the waiting staff a living wage, and avoid all the hassle. Same thing goes for car dealerships. Let me build the car online and then order it. Everyone who gets the same accessories gets the same price. Sure, car dealers wouldn't be able to screw over little old ladies. But it would greatly streamline the car buying process. The average margin over invoice would go down, but so many more cars would be sold that it would surely make up for it.

Sunday, November 13, 2011

Buying a Car: Part 1

I'm going to be getting a car before the end of November. It's going to be a nice, cheap car as my priorities will be price, reliability, safety, and fuel efficiency in that order. Right now I'm leaning towards a new 2012 Nissan Versa SV sedan, which has an MSRP of $15,320.

Why new? I'm pretty cheap (I like to think frugal) in most aspects of my life. So why would I get a new car? Well, the issue with late-model used cars nowadays is that everyone is buying them because of the recession, jacking up the price of used cars close to new cars. For model years 2009, 2010, and 2011, used Nissan Versas (Versii?) are only a few thousand dollars cheaper than new (if that). Now, a Nissan Versa is a pretty cheap car to begin with so this makes sense.

But the first few years of a car's life are its most trouble-free (and that's one of the reasons there's a new car premium). I'm willing to pay a bit more to get the new car and get those reliable years. If a good condition late-model used Versa was dramatically cheaper (say $5,000 to $6,000), I would spring for it. But they're not, so I'll be buying new.

Upon the recommendation of my friend Rich, I am using edmunds.com as a starting point. On the website you specify which make and model of a car that you're looking for. You then give provide your name, address, phone number, email address, and additional comments. Here is my comment:

Contact only via email. Looking to buy the car before the end of November. Show me your most competitive offer.

I put in the comments that I only want to be contacted via email, but all the dealers call anyway. Why only email?

Rich recommends using an email only system right up into purchasing the car. With phone conversations, the dealers can let their inner weasel shine through. If you come to an agreement on the phone and then walk into the dealership, more often than not you hear something like, "Oh, $22,500 was for the basic package, not what we were talking about. That didn't include the steering wheel or windshield."

So, the reasoning for using emails is simple: it's straightforward and everything is written down. You ask the dealer a question and they can respond. If they're not answering your questions, you move onto the next one. If they're changing their answers, you move onto the next one. Everything is already saved in text, so you can refer to it easily.

Once you've negotiated a bit with the dealer via email, ask for a final, walk-out the door price. Print their response and take it with you when you go to the dealership. If they try to charge any more than the agreed price, get up to leave. They'll probably come down to the agreed upon price. If not, there are plenty more fish in the sea.

That last point highlights the most important principle of getting a good deal on a car: not really needing the car. If I desperately needed a car for transportation or if I had to have a particular model, the last thing I would want to do is tell the dealer that. Then the dealer would have me over the barrel, now that they know that they can charge a premium to me because I'm willing to pay up.

So, with all that said, I just submitted my request on edmunds.com to get price quotes. To tell the truth, I've done this before this year and have had some final, walk-out the door offers from a few dealers that were good enough for me. I didn't really need the car at the time so I didn't take them up on it. I will be doing so shortly, though.

I'll be doing further blog updates as I buy this car.

Sunday, November 6, 2011

October Lending Club Update

October Lending Club Update

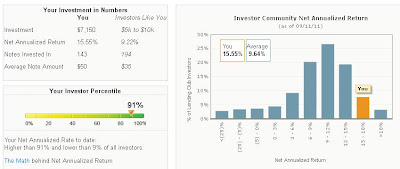

Lending Club update time! Lending Club calculates my returns as

Similar to last month’s NAR of 15.74%. I now have a loan that has been charged off, meaning that there’s no chance that I get my money back. The borrower declared Chapter 7 bankruptcy. Note: this was one of the loans that I talked about last month. Under my current Lending Club filters, I would not invest in this loan because the borrower had 3 inquiries in the last 6 months. My maximum for this category is now 1.

And for you people out there that worry that there are no consequences for defaulting on a Lending Club loan, check out this person’s change in credit score over time.

Yikes. I would like to have my money for this loan (I only received $2.32 and I expected to receive $67.46 over the life of the $50 loan), but I take no joy in seeing someone’s credit score hammered like that. It will be a long time before this borrower will be able to borrow again and they’ll probably have trouble applying for jobs with a credit score like that.

With the charge off, how do I stack up against other investors?

Still holding steady at 92%. And I still have reservations about this number.

That’s about it for this update. One final note: I did cut back on my Lending Club investments to $750/month. In the month of October, I didn’t even meet that lower goal. I only invested $600 across 8 loans. My explanation basically amounts to laziness. My Lending Club filter is an Excel file that sits on my old laptop. My new desktop has all the bells and whistles (and then some) but doesn’t have Microsoft Office, so I have to go back to my old laptop to invest in Lending Club.

Because I use my new desktop for all my other computing needs, that means I have to boot up my old laptop just to invest in Lending Club. So how I used to check out Lending Club every day or every other day, I now only check it out once a week or so. The barrier isn’t that high (all I have to do is boot up my laptop). But there definitely is a barrier now. I’ve been meaning to get Microsoft Office on my new desktop, and not meeting my Lending Club investment goals will probably be the straw that broke the camel’s back.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

Sunday, October 30, 2011

Cyborgs on the Rise

A cyborg is a relatively simple concept that is often misunderstood. Dictionary.com defines it as “a person whose physiological functioning is aided by or dependent upon a mechanical or electronic device.” So we’ve had cyborgs for quite some time. Anyone with a hip or knee transplant where diseased tissue is replaced by artificial tissue is a cyborg. Some argue that anyone who uses glasses is also a cyborg, but I’m not too interested in getting bogged down in definitions.

What I am interested in is how quickly this field is advancing. Progression in this field lightning fast. People care a lot about their health and are willing to spend good money on it, so achievements once thought impossible are now commonplace.

Check out this video that compares current state of the art technology to that in the video game Deus Ex: Human Revolution. It follows Rob Spence, who lost an eye in a shotgun accident and had it replaced with an implanted camera. Rob has given himself the real groaner of a name of Eyeborg.

In the video, Eyeborg compares current eye, arm, and leg prosthetics to those in the game Deus Ex. Basically every prosthetic in Deus Ex is bigger, faster, stronger, and once we get to 2027 I bet we’ll be there. But what I find even more interesting is the philosophical question that lies at the heart of Deus Ex.

David Jönsson, a prosthetics engineer interviewed in the video, sums it up when he say, “I mean, who says that a normal human leg is the optimal thing for you? I mean, the species evolved to this leg that we have now, but who says that is the end of the line?"

That is one of the fundamental questions asked in Deus Ex: Human Revolution. In the game, some people who have normal, functioning bodies have removed biological legs, arms, eyes, etc. to have them replaced with superior augmented technology. Not surprisingly, the company that supplies the drug that these newly augmented cyborgs need to live jacks up the price on them. As a consequence, there are riots and other nastiness.

Would I chop off a functional limb to replace it with a superior mechanical device? Probably not, and I don’t think many people would. For one, I would worry about companies abusing their power as they do in Deus Ex. However, if I lost an arm in a car accident or what have you I absolutely would want to replace it with the newest technology. But I think that’s very different from willingly removing functioning body parts.

But who knows? In the future it’s possible that people will be swapping out arms and eyes like they were getting new cell phones. I’d make an eyePhone joke but Futurama beat me by a few years.

But in the here and now, the real challenge is the brain-computer interface. A lot of the prosthetics currently are controlled by muscles. Directly interfacing them with the brain will most likely be the way to go in the future, but it opens a whole can of worms of bioengineering problems.

But past all the science and engineering, what I find so heartening is that this field is dramatically improving people’s quality of life. It seems like every other week I read about someone who gets a replacement hand who in the past would have had to do with hooks or someone with replacement legs who in the past would have had to make do with a wheelchair.

And the best part about these stories is that it seems like a different company is making each prosthetic. There is a tremendous demand for these products, and that is reflected by so many companies throwing their hats in the ring. Good to see.

This array of cyborg technology is going to have the opportunity to dramatically improve the lives of amputees, the elderly, and the disabled. There’s a good chance that normal people will start using it to augment their bodies, as well. The near future is going to be an exciting and scary time, full of ethical dilemmas. I, for one, am excited to watch it unfold firsthand.

Sunday, October 23, 2011

Battlefield 3 Is Coming Out Tuesday!

I have Battlefield 3 fully loaded and ready to play for when it comes out on Tuesday. I’m pretty pumped and it looks like other people are as well, as the Battlefield 3 Launch Trailer is the #1 most viewed video today on YouTube.

I’ll be posting a full Let’s Play of the entire single player on my YouTube channel, where I already have a few videos of the beta. I know the main draw of the Battlefield games is the multiplayer (in fact, some of the titles in the series don’t have a single player). However, I know a lot of people want to see the full single player, so I’ll be putting that up in addition to sprinkling multiplayer videos here and there.

See you Tuesday!

Sunday, October 16, 2011

Sunday, October 9, 2011

September Lending Club Update

Lending Club update time! Lending Club calculates my returns as:

Similar to last months NAR of 15.55%. Interesting to see that I have two loans that are in the Late 31 – 120 Days category now. Let’s take a look at each of these loans. The details on the first:

The first thing that jumps out at me is the inquiries in the last 6 months category. This borrower has 3 inquiries in the last 6 months, so I would have excluded this loan based on my new Lending Club filter of just 1 credit inquiry in the last 6 months. The second late loan:

Hmm… Nothing jumps out at me as a red flag for this loan. I will continue to evaluate which loans become late or default and change my investing strategy to minimize my defaults and maximize my returns.

Defaults suck and it is much more likely that these loans will default now that they are between 31 – 120 day late. However, my investment goal in Lending Club (and I’m repeating myself here) is to maximize my returns NOT to eliminate defaults entirely. I’ve seen quite a few investors fund only A loans in the 6% interest range because they are default averse. If these investors see no defaults whatsoever, they will be getting that 6% interest as a return.

If I fund loans with an average of 16% interest, I will have to see 10% more defaults to have a lesser return than the cautious investor. Historically, this difference has been much smaller than 10%. Granted, Lending Club has been around only since 2006 and past performance is no guarantee of future returns, but investing in higher interest loans is going to be my strategy for the time being.

With all that said, how do I stack up against other investors?

I'm holding steady at 91%. As I mentioned in last month's update, I have some faults with this investor comparison. However, it does provide some information, so I’ll continue to include it in my updates.

I’m getting a little bit lazier (or maybe just focusing too much time on my YouTube channel), so I won’t be including my calculations of my NAR in these monthly updates. I’ll include them every quarter from now on (next one for December).

One final note: I’m cutting back my Lending Club investments from $1,500/month to $750/month. The difference I’m just going to throw into a savings account for the purpose of helping to pay off my girlfriend’s student loans when she graduates medical school in 2 years. The Lending Club loans that satisfy my investing criteria are 90% 5 year loans and I would like to have some liquid cash before then. At $750/month and $75/loan, I will only need to find 10 loans/month to fund. I’m reasonably happy with that as I seem to be getting busier and busier.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

Monday, October 3, 2011

My Google Adsense Account Has Been Disabled

Last Thursday I got an email from Google with this in the body:

After reviewing our records, we've determined that your AdSense account poses a risk of generating invalid activity. Because we have a responsibility to protect our AdWords advertisers from inflated costs due to invalid activity, we've found it necessary to disable your AdSense account. Your outstanding balance and Google's share of the revenue will both be fully refunded back to the affected advertisers.

I am disappointed but will continue on with my blog. I plan on appealing the decision in the near future, but not now as I’ve got a lot on my plate. I believe that my click-through rates are about standard. It was just that a handful of my well-intentioned but knuckleheaded friends got on my blog and spammed all my ads. It’s no surprise that this sent up red flags for Google. So, I have the following plea:

If and when I get ads on my blog again, PLEASE DON’T CLICK THEM UNLESS YOU ARE TRULY INTERESTED IN THE AD.

Because of this, I will be suspending my monthly blog income updates for the time being (because they will all be $0!). Don’t worry, though, Grabowski fans. I still plan on continuing my weekly updates.

In other news, the Battlefield 3 Beta marches on. I look to post another video to my YouTube channel tonight. Until next time!

Thursday, September 29, 2011

Sunday, September 25, 2011

Stand and Deliver!

A few months ago I read about the health benefits of standing, so I started standing at my desk for an hour or so at work. After a few weeks, I increased that to standing then sitting off and on for an hour each. Recently, I’ve been standing for most of the day, and it feels pretty good.

On the weekends, I find myself sitting in front of a computer for a long period of time (contrast that with my work where I’m now standing in from of a computer for a long period of time). And on the weekends, I feel a little more sluggish, like I lose a step. There’s a good chance that this weekend funk is all in my head. Nevertheless, I think I’m going to buy a standing desk for my apartment so that when I’m goofing off and posting video game videos to my Youtube channel I’m at least getting a tiny bit of exercise.

And I’ve found that tiny bit of exercise should not be discounted. According to several recent studies,

If you spend most of the rest of the day sitting — in your car, your office chair, on your sofa at home — you are putting yourself at increased risk of obesity, diabetes, heart disease, a variety of cancers and an early death. In other words, irrespective of whether you exercise vigorously, sitting for long periods is bad for you.

Yikes. With that in mind, I kicked my search for a standing desk into high gear. I don’t need anything too fancy. My work has desks that can be adjusted by the press of a button, but that’s more than I need.

It looks like Amazon has a few choices. I’ll probably start there and go to a Home Depot or Lowe’s to see if they have any standing desks. By the end of October, I look to have a standing desk assembled in my apartment. I’ll report back in with my results then.

The health benefits of standing versus sitting are now reasonably documented in the annals of science. Less clear are the benefits to mood and alertness. But there’s at least some anecdotal evidence to support standing:

Greg Hoy, 39 years old, asked for a standing desk shortly after joining Facebook seven months ago as a design recruiter. "I don't get the 3 o'clock slump anymore," he said. "I feel active all day long."Tiffani Jones Brown, 29, said she also requested a standing desk when she joined Facebook two months ago as a content strategist, in part to keep her energy level high. "I get really tired when I sit all day," Ms. Jones Brown said.

I feel the same way when I sit all day. Hopefully standing for a few hours on Saturday and Sunday cures my weekend doldrums.

Sunday, September 18, 2011

Let's Play Trine

My first "real" Let's Play is up, Let's Play Trine. Trine is an indie title released back in 2009 which I describe as a modern The Lost Vikings with more physics puzzles. It's a pretty fun game and on the scale of don't play to play, I rate it a play. The second video should be posted up tonight.

As it's my first Let's Play, there are still some kinks to work out. My voice is drowned out a little bit by the music and voice acting, so I'll tone those down next time I sit down and record. Also, it's taking a long, long time (hours) to post these videos to YouTube. I can definitely optimize this, so I'll be looking into that as well.

As it's my first Let's Play, there are still some kinks to work out. My voice is drowned out a little bit by the music and voice acting, so I'll tone those down next time I sit down and record. Also, it's taking a long, long time (hours) to post these videos to YouTube. I can definitely optimize this, so I'll be looking into that as well.

YouTube Account!

It’s an exciting moment for all you Grabowski fans out there: I just started a YouTube channel. I’ll be focusing on doing Let’s Play videos. For you old timers, that’s where you play a video game and comment as you go along. Then, you post it to YouTube with minimal editing!

My first video is already up, Let's Play Solitaire. It was mostly a test to see that my video recording software works. Later today, I’ll be posting the first of my Let’s Play Trine series. Trine is a fun indie game that was released a couple years back. I’ll be playing the games that I like to play, so mostly major titles with a few indie gems sprinkled in. I’m looking forward to growing this channel!

Sunday, September 11, 2011

August Lending Club Update

Lending Club update time! As I did in previous months, I’ll show you my investing returns in two ways. First, what Lending Club calculates for me:

Pretty consistent with last month’s number of 15.42%. My NAR has crept up a little bit because I’ve been investing in more notes with higher interest rates recently. Interesting to note that I’ve had another loan fully repaid. How do I stack up against other Lending Club lenders?

Also pretty similar with last month. Here's an interesting article on this investor percentile comparison from Peter at Social Lending Network. In the article, Peter makes the case that this tool should compare your portfolio against others with similar loan ages. I agree 100%.

As it currently stands, any new portfolio is going to have this investor percentile number inflated. This is because it takes 120 days for a loan to go into default, so new portfolios have no chance of a default hitting their sheets.

As an investor, I like having the investor percentile tool. But I don’t want to compare my returns to someone else’s who just set up their account and has none of the older loans that I have. I want an apples to apples comparison. If I can compare my portfolio to portfolios with similar loan ages, then that investor percentile number is infinitely more useful in providing an accurate read of the quality of my investing strategy.

With that said, I’m going to keep including the investor percentile tool in future updates. I just hope that Lending Club revises it so that it compares my portfolio to others with similar average loan ages.

Now let’s calculate my returns using the Lending Club monthly statements.

As of 8/31/2011, I have $8219.82 in my Lending Club account. Using the XIRR function in Excel, I get a calculated NAR of

Just like last month, there is a discrepancy between my NAR and the NAR calculated by Lending Club. And just like last month, I believe most of the discrepancy arises from my most recent deposit of $1,500 on 8/16/2011. There’s nothing wrong with this deposit, but because I didn’t immediately invest the cash into loans, it will weigh heavily on my NAR. If you look at my NAR using the account total for today, you find

This 14.04% is much closer to the 15.55% generated by the Lending Club website.

As I mentioned last month, I set up a recurring transfer of $1,500/month into my Lending Club account. Even though I invested $1,500/month in July and August, I have since disabled this recurring transfer. This is because I have had around $1,400 or so of available cash that’s just been sitting in the account. Once I have invested this amount and my available cash is close to $0, I will start the recurring transfer back up again.

A quick note on the recurring transfer: I talked to a Lending Club representative and was told that there was still a 1.5% cash bonus for recurring transfers (as I mentioned last month). I explained that I could not find a link to get this set up on the site. The representative told me that she would activate it for my account. Of course, because I have since disabled recurring transfers, I will no longer receive this bonus.

So, if you want to have this bonus activated but can’t find it on the Lending Club site, I encourage you to contact Lending Club. I will provide an update on the cash bonus once I have re-enabled my recurring transfers.

A final note: I am bumping up my loan investments from $50/loan to $75/loan. Keeping my monthly transfer the same at $1,500, this means I will only have to find 20 suitable loans per month instead of 30. Loans that pass my filters are getting a little bit more uncommon (no surprise as my filters get stricter), so this will enable me to deploy the capital that I want on a monthly basis.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

Monday, September 5, 2011

Prisons and Punishment: Part 2

Last week I posted about how prisons in the USA were focusing on punishment and not rehabilitation of prisoners. This week we’ll look at a couple of programs that the American penal system could implement to improve prison conditions and recidivism rates.

Let’s look at a relatively novel idea: using cats in prison to calm inmates and maintain order. It is an idea that is realized in Indiana State Prison. Inmates there can request to own cats administered by the prison. If the inmates meet certain requirements (such as a record free from animal abuse), the prison then provides them with a cat that they care and provide for. The Assistant Superintendent of the prisons states

I know there are people out there who think the offenders shouldn’t have cats. Some people don’t want them to have TV or anything to do. But I would support this cat program at any prison. Those cats humanize the men. The cats give them unconditional love, for many of those guys, that may be the only love they have ever experienced in their lives. And the bottom line for me, is that my staff are safer because of it. Every day that none of my staff gets hurt—that’s a good day. Watching over these guys is a dangerous job. And anything that makes that job safer is good with me.

So the prisoners like the cats and so do the guards, but there are Americans out there who hate prisoners having cats. Prison, in their minds, is to punish, punish, punish prisoners. Having cats is absurd, never mind that everyone directly involved in the situation prefers that the prisoners can own cats. The prisoners are happy because they get new friends that help them relax, and the guards are happy because the now calmer prisoners make their jobs safer.

I consider that a pretty tame example. Now let’s go extreme. In Norway, there is a prison where inmates have easy access to "knives, axes, and even chainsaws". Why? The prisoners there use the knives to cook in the kitchen, and the axes and chainsaws to saw logs to sell to businesses. You see, the inmates there have real jobs with real responsibilities and live in cottages instead of jail cells. The name of this Nordic prison is Bastoy and the warden there is Arne Kvernvik Nilsen. His theory on prisons

Both society and the individual simply have to put aside their desire for revenge, and stop focusing on prisons as places of punishment and pain. Depriving a person of their freedom for a period of time is sufficient punishment in itself without any need whatsoever for harsh prison conditions.

Bastoy takes the opposite approach to a conventional prison where prisoners are given no responsibility, locked up, fed and treated like animals and eventually end up behaving like animals.

Here you are given personal responsibility and a job and asked to deal with all the challenges that entails. It is an arena in which the mind can heal, allowing prisoners to gain self-confidence, establish respect for themselves and in so doing respect for others too.

I’m glad to see that a focus on actually rehabilitating prisoners is being put into practice successfully: Bastoy not only has the lowest reoffending rate (recidivism is the word for those of us across the pond) in all of Europe at 16%, it is actually cheaper to run than a conventional closed prison. This is because the prisoners of Bastoy produce their own food and fuel. In fact, all the food at the prison including that eaten by the guards is prepared by inmates, displaying a level of trust that is nowhere to be found in America.

Compare that with this story from a few years ago in the United States. An inmate attacked a deputy and put him in a chokehold. Other inmates jumped up to fight off the first inmate, and are credited with saving the deputy’s life. I’m glad the story ended this way, but I still find it sad. That’s because it’s a newsworthy event that the other inmates saved the deputy. It’s basically expected that they should have left the deputy to die. In contrast, in Bastoy, there has never been a violent incident.

In America, we treat our prisoners like animals and that’s what they become. That’s a damn shame.

Sunday, September 4, 2011

August Blog Income Update

August update time! In the month of August, my earnings were

My past earnings in graphical form:

I had a pretty big bump in earnings and I’m pleased with the upward trend. As Dennis Gartman of the Gartman Letter would say, this graph is very clearly moving from the lower left to the upper right.

However, that truly is a pretty massive jump (percentagewise, of course) in monthly income and maintaining that income is probably not sustainable for September. For September I would be ecstatic if I maintained $50/month and would be content if I earned $10/month, as in July.

Sunday, August 28, 2011

Prisons and Punishment: Part 1

The criminal justice system in America is badly broken. There are a multitude of problems with it, and fixing any of them starts with understanding the fundamental purpose of prisons. There are four reasons to incarcerate someone:

1. To isolate criminals to prevent them from committing more crimes

2. To punish criminals for committing crimes

3. To deter others from committing crimes

4. To rehabilitate criminals

Let’s use these four reasons as a basis to examine one of the problems of the modern American criminal justice system, namely the imprisonment of nonviolent drug offenders. Now, the United States of America has the largest prison population in the world (a fact that’s at least mildly ironic for those of us who live in the Land of the Free). This population has quadrupled since the 1980s but it’s not due to increases in violent crime, it's because of the War on Drugs. Mandatory minimum sentencing and three strikes laws are the primary culprits.

The result? The US prison population is composed of a shockingly high percentage of nonviolent drug offenders.

Do we need to isolate these people (#1)? I would argue that’s unnecessary because they aren’t really hurting anyone with their crimes. What about punishing them (#2)? These people are being punished for breaking the law, but it’s a law that is becoming increasingly unpopular. Hell, California almost legalized marijuana in 2010 with Prop 19. And it’s not deterring others (#3). The National Survey on Drug Use and Health reports that at least 16.7 million Americans used marijuana in 2009, the highest number ever reported.

But the biggest issue lies in rehabilitation of criminals (#4). Locking up these nonviolent offenders in prison does not rehabilitate them so that they can safely be reintroduced into society as functioning members. In fact it does the opposite. Prison hardens these people making it more likely they commit serious crimes in the future.

Our biggest problem with incarceration in this country is that we’ve gone overboard on punishment (#2) to the detriment of what should be the real reason for our prisons, rehabilitation (#4). Next week we’ll look at some ways we can lighten up on punishment and focus more on the actual rehabilitation of our prisoners.

Sunday, August 21, 2011

Film the Police

One of the greatest victories for civil liberties is the widespread availability of personal recording devices. Advances in technology have dramatically decreased the size of video cameras which means that the public is no longer limited to bulky and unwieldy equipment for personal recordings. Because practically every smart phone has decent video recording capabilities, crimes committed in the public arena that would have gone unreported or unprosecuted due to lack of video evidence are now being punished. Refreshing.

Look at the riots in Britain. In this video recorded by a civilian, hooligans pretend to help a badly injured man to his feet only to steal items from his backpack. The YouTube video was viewed by millions, leading to the identification of the thief, Reece Donovan. He will most likely spend a long time behind bars. In the past, this piece of human garbage would have likely gotten away scot free. The ubiquity of personal recording has prevented that injustice, and many others.

But people don’t use their smart phones just to record ordinary civilians committing crimes, they also record crimes committed by those in power, including police. Most police are moral, but power corrupts, and police have a lot of power.

When I have an idea for a blog post I write it down and over the course of the next month or two, I bookmark news articles related to the central idea. So for this post, I bookmarked news articles that had police either being caught on camera committing crimes, police trying to take away cameras after being recorded, or police trying to prosecute civilians who lawfully recorded the actions of the police. Unfortunately, there are a lot of examples.

However, police shouldn’t be afraid of being recorded in public if they are following the law. Note: this is MUCH different than the statement, “If you have something that you don't want anyone to know, maybe you shouldn't be doing it in the first place,” famously spoken by former Google CEO Eric Schmidt. This has been widely condemned and rightfully so.

What’s the difference? The key is the right to privacy. It is illegal to disclose the private information of others. However, in public there is neither the right nor the expectation of privacy. If I walk down the street wearing a clown costume and riding a unicycle, that act is now public information and there’s not a damn thing I can do about it.

So cops should expect everything they do in public to be public information, and should not be scared of being recorded by civilians. I’ve heard the argument that being recorded makes a cop’s job hard. Let me clear, cops have a tough job to begin with. But (and I’m repeating myself here), there is no right to privacy in public. Cops should assume they are being recorded at all times in the public, because in the near future, they will be.

Not that the police are quietly accepting being recorded. On the contrary, there are now three states where it is illegal to record any on-duty police officer for any reason under any circumstances. That’s patently absurd.

If I had all the money in the world, I would fight those laws tooth and nail. Furthermore, I would start a YouTube channel of just police recordings. The channel wouldn’t only be videos of police committing crimes, but it would certainly have those. If someone was being prosecuted for lawfully recording the police, I would pay for their defense. This would be a great defense of civil liberties. In fact, I can’t think of anything more patriotic, so this would be our logo.

I didn't create this but I can't seem to find the person who did to properly credit them.

Finally, I want to end on a positive note. Here is a video of someone recording a police officer that goes pretty smoothly. Just as this police officer says in the video, it’s the inalienable right of the civilian to record the police in public.

Sunday, August 14, 2011

July Lending Club Update

Lending Club update time! After discussing strategy with Peter from Social Lending, I am revising my Lending Club investment strategy. Peter pointed out that #9 in my list of Lending Club filters (remove loans of borrowers with more than 5 credit inquiries in the last 6 months) was not a great filter. First, it wasn’t really removing any borrowers from my investment pool. Second, after reviewing past loans and their performance on Lend Stats, it became pretty clear that by actually limiting number of inquiries less than or equal to 1, you could pretty dramatically improve results.

So, that’s what I’ve done. I’ve changed this filter to remove borrowers with more than 1 inquiry in the past 6 months. On a related note, Peter explains why credit inquiries is his favorite P2P filter here.

As I did last month, I’ll show you my investing returns two ways. First, what Lending Club calculates for me:

Pretty consistent with last month. Interesting to note that I had one note already paid in full, which will happen. For an investor like me, this is not what you'd like to happen but it's certainly better than a default. Now how do I stack up against other Lending Club lenders?

Also pretty similar with last month. Now let’s calculate my returns using the Lending Club monthly statements.

As of 7/31/2011, I have $6665.0 in my Lending Club account. Using the XIRR function in Excel, I get a calculated NAR of

Hmm… my calculated 12.86% is pretty different from the 15.42% calculated by the Lending Club website. Why is this the case? Well, as I mentioned before and as Social Lending reiterated this week, the Lending Club formula doesn’t properly account for money sitting as idle cash. I believe the NAR discrepancy is from when I deposited $1,500 on 7/18/2011 and didn’t immediately invest all the cash into loans. If you look at my NAR using the account total for today, you find

This 14.92% is much closer to 15.42% generated by the Lending Club website.

Finally, I’d like to mention how I’m depositing money into Lending Club. After some thought, I’ve decided to schedule a recurring monthly transfer of $1,500. With my investing strategy of $50/loan, this gives me 30 loans to pick during the month, or about 1 per day. Picking one loan per day on average is something that I can keep up with. In fact, I prefer it that way over just dumping in a lump sum of money that I won’t immediately invest.

Furthermore, Lending Club offers a recurring transfer bonus program bonus of up to 1.5%. If you set up a recurring transfer of greater than $500, you get 1.5% back about three months after investing the funds (for transfers between $200 and $500, the bonus is 1%). That almost immediate return beats almost all saving account returns out there.

Sound too good to be true? It just might be. While this recurring transfer cash bonus definitely existed at one point, it may not any longer as I can’t find it on the Lending Club website. I have emailed the Lending Club support to find out if the program is still in effect.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

Sunday, August 7, 2011

July Lending Club Update Delayed Until Next Week

This morning I wrote that I would have my July Lending Club update up later in the day. Unfortunately I don't have my July monthly statement from Lending Club (the site says monthly statements are generated one week after the end of each calendar month, so I thought the statement would be available today. I was wrong). I use this statement to calculate my net annualized return (NAR) to compare to the NAR generated by the Lending Club website. Without it, I will have to delay the update to next week.

July Blog Income Update

July update time! In the month of July, my earnings were

My past earnings in graphical form:

I had a slight bump in earnings. This is mostly from Peter Renton mentioning my Lending Club series on his site, Social Lending. I’ll have more on that later today in my monthly Lending Club update. I plan to revise my investing strategy as I have taken a more in-depth look at Peter’s P2P strategies and I like what I see.

Sunday, July 31, 2011

Chinese Train Derailment

On July 23rd, two-high speed trains collided in China causing 40 deaths and 192 injuries. The crash is being blamed on government corruption and the ensuing cover-up has caused a public furor. Many see the situation as a metaphor for the unchecked growth that the Chinese government is pursuing.

Let me be clear, I admire the Chinese for using the government to build up their infrastructure. The 20th century American investment in our highway system has returned untold dividends. There are a few things that I believe are difficult to fund too much: preventive maintenance and upgrades to basic infrastructure, basic science, and education (this does not include the current debauchery of the student loan system, but that’s a post for another day).

So I don’t fault the Chinese for building up their infrastructure. Where I do find blame is their rampant government corruption. Reports have come out stating that the Chinese government has been taking people’s land without fair compensation. The WSJ reports that there have been two recent firings of high ranking members of the Chinese railways ministry for graft. I think in the coming weeks we’ll find that the Chinese trains and their tracks weren’t built to spec with the government officials pocketing the difference between public safety and peril.

Listen, I live in Chicago, so I know a corrupt government (Some attribute “Vote early and vote often.” to our own Al Capone, but it was used earlier). Power corrupts, and that is certain. But there are ways to check government power and therefore corruption.

It’s said that “Sunlight is the best disinfectant.” A system of checks and balances for the government is needed, with an educated public and the media playing a vital role. And on a positive note, the Chinese people are increasingly connected and working together to hold the government accountable.

As noted in this WSJ article, in 2000 there were 10 million Chinese on the Internet. Now there are estimated to be 485 million. The Chinese version of Twitter, Weibo, is an increasingly popular communication tool. The WSJ notes

The government censors much content on the Internet, but it has allowed a surprising degree of openness on Weibo and other sites. In part, experts say, that's because it sees online commentary as a release valve for the public, but the government also fears the fury that would erupt if it took away those outlets.

I disagree with the experts here. The Chinese government doesn’t censor Weibo to allow a release valve for the public. Weibo isn’t censored because it’s not feasible to censor it and still allow it to exist. How can you monitor, much less politically censor, a Twitter clone that has nearly eight times more users than Twitter? To me there are two choices for the Chinese government in this situation: shut down Weibo outright or have a trivial amount of censorship of the site that amounts to nothing.

While the Internet is relatively open, China is cracking down on traditional state media reporting of the train accident, as reported by the New York Times today.

The sudden order from the Communist Party’s publicity department, handed down late Friday, forced newspaper editors to frantically tear up pages of their Saturday editions, replacing investigative articles and commentaries about the accident that killed 40 people in eastern China with cartoons or unrelated features.

Replacing tragic news with cartoons? This would be funny if it weren’t so sad. Because the Chinese people won’t be able to get news from the state-run media, they’ll increasingly look to the Internet. I just hope that they’ll still be able to access it.

Subscribe to:

Posts (Atom)